Introduction

The Generative Pre-trained Transformer (GPT) has taken the world of AI by storm, and OpenAI’s latest release, GPT-4, is no exception. With its multimodal capabilities and unprecedented sophistication, GPT-4 is redefining the landscape of language models. In this blog post, we will explore what GPT-4 is, how it works, and its numerous applications and possibilities, including an introduction to GPT-4 plugins and prompt ideas to help you get started with this groundbreaking AI technology.

GPT-4: The Basics

Developed by OpenAI, GPT-4 is the latest iteration of the company’s foundation model. This multimodal model is capable of mimicking human-like prose, art, video, or audio. OpenAI unveiled GPT-4 on March 14, 2023, and it’s available for ChatGPT Plus subscribers at $20 per month.

GPT-4 is owned by OpenAI, a San Francisco-based AI company backed by Elon Musk, Microsoft, Amazon Web Services, Infosys, and other corporate and individual supporters. The company is also behind ChatGPT, a chatbot powered by GPT-3.5, and DALL-E, an image-generating deep learning model.

GPT-4: Technical Information

GPT-4 is a multi-layered artificial neural network with 100 billion neurons and 100 trillion synapses. It can communicate in 95 different languages and process up to 25,000 words (approximately 52 pages of text) at a time. GPT-4 can also generate code for various programming languages such as Python, Java, JavaScript, C++, Ruby, PHP, Swift, and Kotlin.

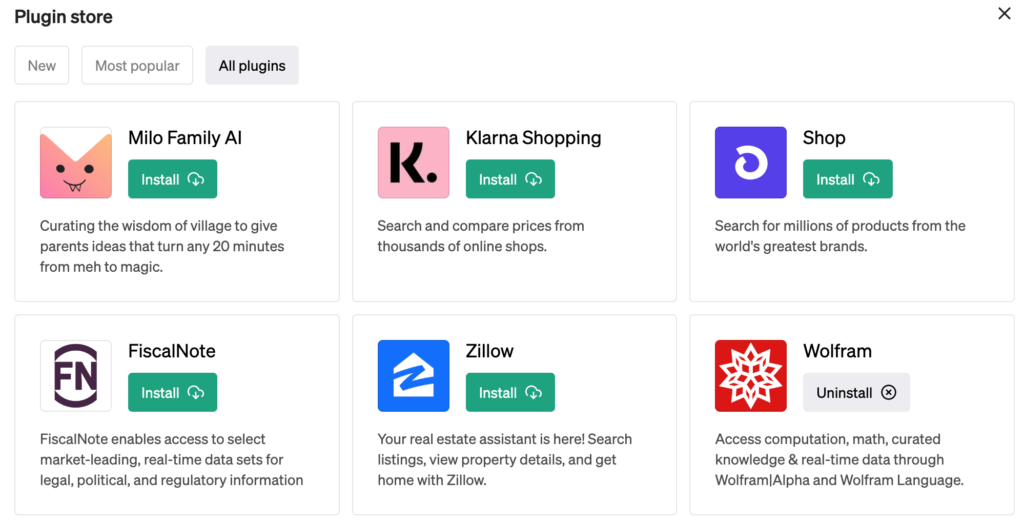

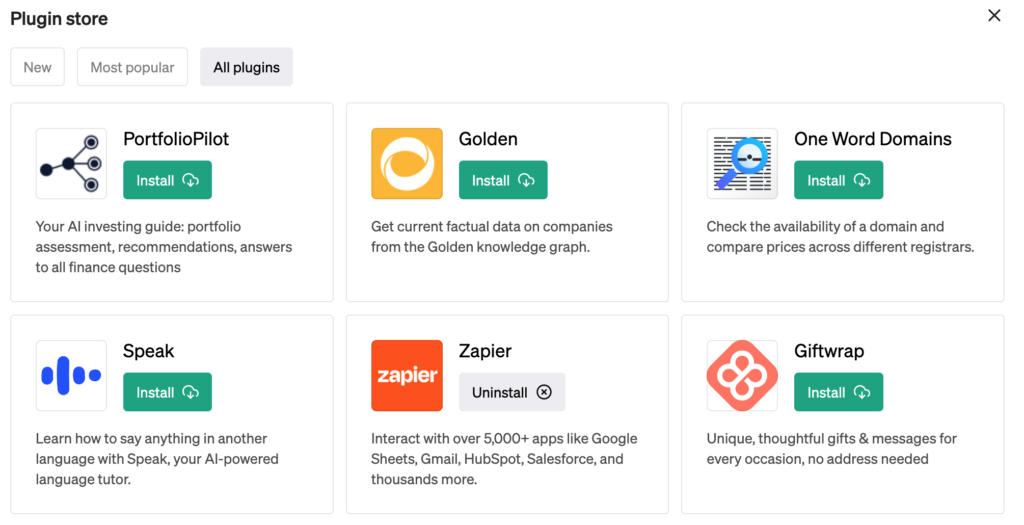

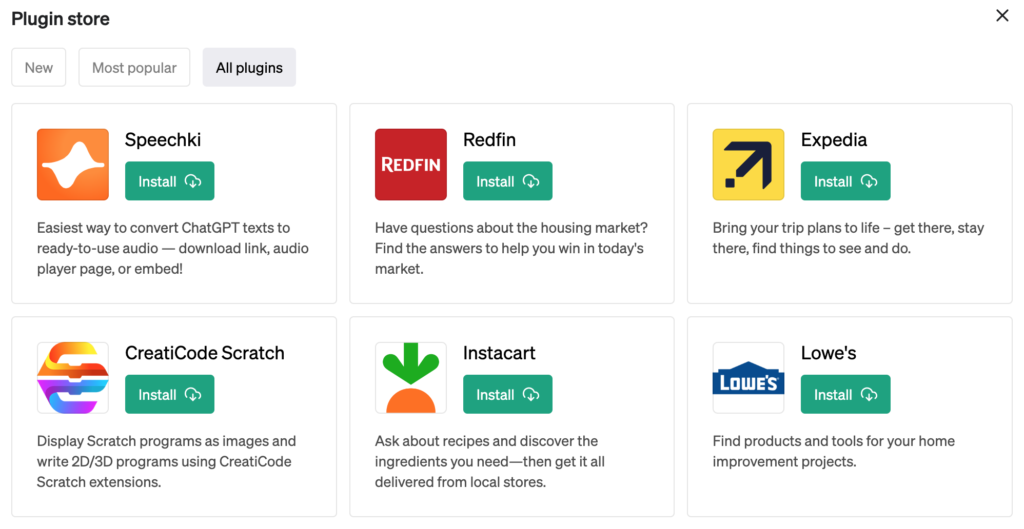

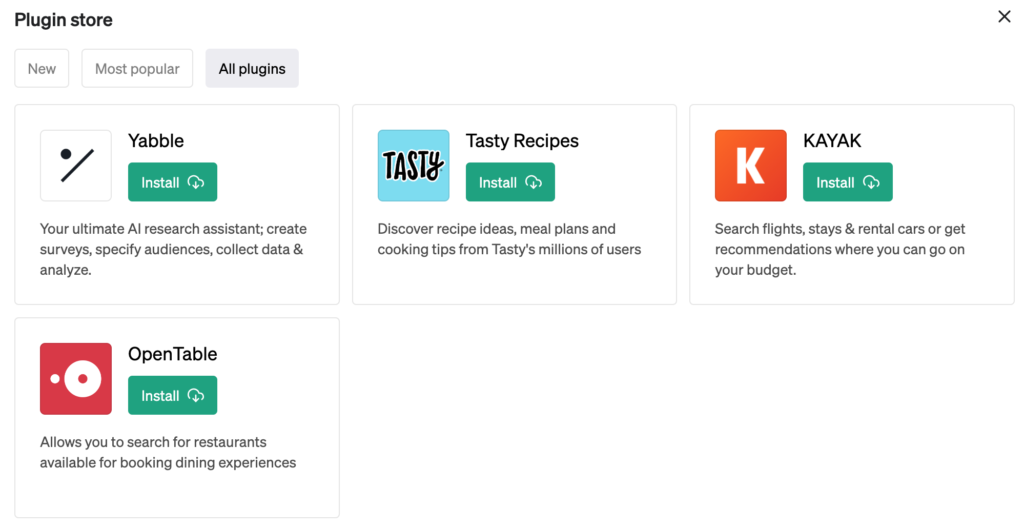

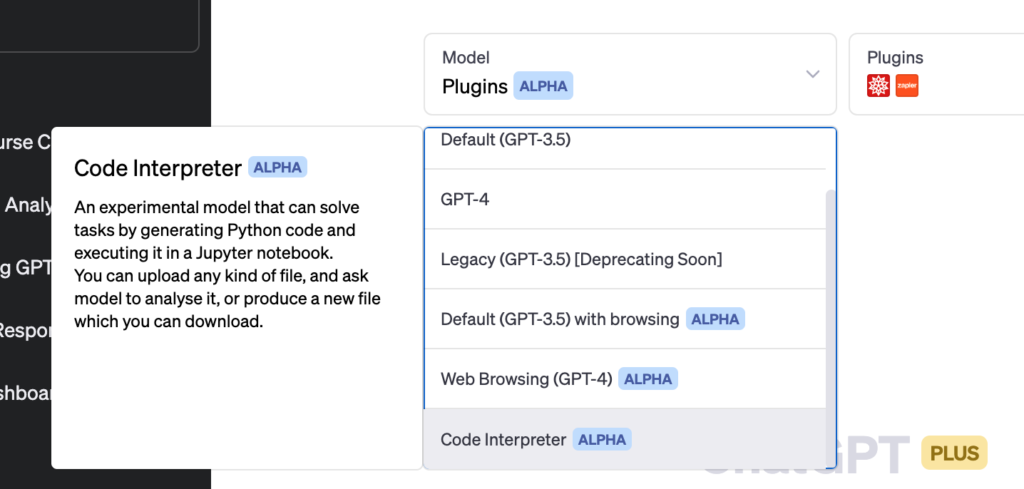

GPT-4 Plugins

With GPT-4 plugins, users can connect ChatGPT Plus to third-party applications and APIs. For instance, the Zapier plugin allows users to connect ChatBot with thousands of popular apps for automation, while the Wolfram plugin empowers ChatGPT with computational abilities, accurate math, curated knowledge, real-time data, and visualization through Wolfram|Alpha.

Wolfram Plugin for ChatGPT:

https://www.wolfram.com/wolfram-plugin-chatgpt/

Zapier Plugin for ChatGPT:

https://zapier.com/blog/announcing-zapier-chatgpt-plugin/

Instacart Plugin for ChatGPT:

https://www.instacart.com/company/updates/instacart-chatgpt/

Zillow Plugin for ChatGPT:

https://www.zillowgroup.com/news/discover-zillows-plugin-on-chatgpt/

FiscalNote Plugin for ChatGPT:

https://fiscalnote.com/press-room/fiscalnote-selected-by-openai-for-collaboration-as-inaugural-launch-partner-for-openais-chatgpt-plug-in

Speechki Plugin for ChatGPT:

https://speechki.org/articles/transform-your-content-with-voiceover-by-chatgpt-and-speechki-plugin/

PortfolioPilot Plugin for ChatGPT:

https://twitter.com/alexharm/status/1653787155410620417

Klarna Shopping Plugin for ChatGPT:

https://www.klarna.com/international/press/klarna-brings-smoooth-shopping-to-chatgpt/

With GPT-4 with browsing you can browse the Internet to get answers and you can analyze content on the web.

With GPT-4 Code Interpreter, you just have to upload the data and provide instructions in simple English. The model does everything from cleaning data to generating insightful visualizations on autopilot.

GPT-4 Applications

- Chatbots and conversational agents – GPT can generate human-like responses by analyzing the context of a conversation and predicting the most appropriate answer based on previous responses and training data. https://twitter.com/chillzaza_/status/1635823687172603906

- Automated content creation and copywriting – GPT can generate written content and advertising copy by analyzing a topic or keyword, and using this information to generate creative and engaging content. https://www.copy.ai/ … https://texta.ai/ … https://www.jasper.ai/ … https://rytr.me/ … https://anyword.com/

- Language modeling and understanding – GPT can understand the structure and patterns of language by analyzing large amounts of text data, and use this information to generate new text or classify text data. https://converseon.com/resources/webinars/conversus-demo-april-webinar/

- Text completion and auto-correction – GPT can predict and complete words or sentences by analyzing the context of a text input and predicting the most likely word or phrase to complete the sentence or text. (try this in the ChatGPT interface at https://chat.openai.com/ )

- Sentiment analysis – GPT can analyze text and determine the sentiment or emotional tone of the text by detecting and classifying positive, negative, or neutral language. (try this in the ChatGPT interface at https://chat.openai.com/ )

- Question answering and information retrieval – GPT can analyze text and answer questions by retrieving relevant information from a database or corpus of text. (for some cases, try this in the ChatGPT interface at https://chat.openai.com/ and for others use Zapier plugin to access the corpus of text: https://zapier.com/apps/chatbot/integrations )

- Personalized recommendation systems – GPT can analyze a user’s behavior and preferences to provide personalized recommendations for products, services, or content. https://www.instacart.com/company/updates/instacart-chatgpt/ … https://skift.com/2023/03/23/expedia-and-kayak-offer-early-convergence-of-chatgpt-and-travel-booking/

- Speech recognition and transcription – GPT can transcribe spoken language into text by analyzing and interpreting audio input using natural language processing techniques. https://get.otter.ai/interview-transcription/

- Image and video captioning – GPT can generate descriptive captions for images and videos by analyzing the content and context of the visual input. https://twitter.com/tomsmith585/status/1641866281426239489

- Text classification and categorization – GPT can categorize and classify text into predefined categories or topics by analyzing the content and context of the text. https://micsymposium.org/mics2023/wp-content/uploads/2023/03/MICS_2023_paper_3429.pdf … (you can also try this in the ChatGPT interface with your own text corpus at https://chat.openai.com/ )

- Summarization and abstraction – GPT can summarize long texts or generate abstracts by identifying key concepts and themes in the text and synthesizing them into a condensed form. (try this in the ChatGPT interface at https://chat.openai.com/ )

- Neural machine translation – GPT can translate text from one language to another by analyzing the context and structure of the input text and generating a corresponding translation in the target language. (try this in the ChatGPT interface at https://chat.openai.com/ )

- Virtual assistants and voice-enabled interfaces – GPT can power virtual assistants and voice-enabled interfaces by interpreting user input, generating responses, and executing commands. https://twitter.com/MateMarschalko/status/1640401459115180045 … https://matemarschalko.medium.com/creating-samantha-from-her-by-fine-tuning-gpt-3-on-the-movie-script-dabdbf78b883 …

- Medical diagnosis and prognosis – GPT can analyze medical data and predict diagnoses and prognoses based on patterns and trends in the data. https://www.notablehealth.com/platform#patient-ai …

- Fraud detection and prevention – GPT can analyze financial data and detect fraudulent activity by identifying patterns and anomalies in transaction data. https://www.freethink.com/robots-ai/stripe-gpt4

- Financial forecasting and analysis – GPT can analyze financial data and provide forecasts and insights on market trends and performance. https://www.bloomberg.com/company/press/bloomberggpt-50-billion-parameter-llm-tuned-finance/

- News article generation – GPT can generate news articles by analyzing a topic or event and generating coherent and informative text based on the analysis. (try this in the ChatGPT interface at https://chat.openai.com/ )

- Creative writing assistance – GPT can assist in creative writing tasks by generating suggestions and ideas based on a given prompt or theme. https://twitter.com/TMitrosilis/status/1611361249735892992

- Chat-based customer service and support – GPT can provide automated customer service and support through chat-based interactions, by analyzing user inquiries and providing relevant responses. https://www.techtarget.com/searchcustomerexperience/feature/How-to-use-ChatGPT-for-customer-service

- Automated email response and management – GPT can automate email response and management by analyzing incoming emails and generating relevant responses based on the content of the email. https://www.youtube.com/watch?v=6DaJVZBXETE

GPT-4 Prompts:

A ChatGPT prompt is an instruction or discussion topic a user provides for the ChatGPT AI model to respond to. The prompt can be a question, statement, or any other stimulus intended to spark creativity, reflection, or engagement. Users can use the prompt to generate ideas, share their thoughts, or start a conversation. You can write/paste prompts into the ChatGPT interface at https://chat.openai.com/ . We’ve provided a great resource for prompts in the Resources section below.

Conclusion

GPT-4 is revolutionizing the world of AI with its powerful language generation capabilities, innovative plugins, and diverse applications. Whether you’re looking to improve productivity, generate creative content, or explore cutting-edge AI technology, GPT-4 offers a world of possibilities. Get started by trying out our suggested productivity and copywriting prompts or create your own to unlock GPT-4’s full potential. With its incredible versatility and seemingly limitless potential, GPT-4 is poised to become an indispensable tool in various industries and applications, from content creation to customer service and beyond. Experience the power of GPT-4 and discover how it can transform the way you work, create, and communicate.

…..

RESOURCES:

https://openai.com/research/gpt-4

https://openai.com/blog/chatgpt-plugins

https://en.wikipedia.org/wiki/GPT-4

https://en.wikipedia.org/wiki/Large_language_model

https://www.eweek.com/artificial-intelligence/generative-ai-apps-tools/

https://medium.com/@fenjiro/chatgpt-gpt-4-how-it-works-10b33fb3f12b

https://writesonic.com/blog/chatgpt-prompts/

https://twitter.com/jconorgrogan/status/1635695064692273161

https://twitter.com/thealexbanks/status/1635704687344365569