SUMMARY OF SOCIAL LISTENING – 2019:

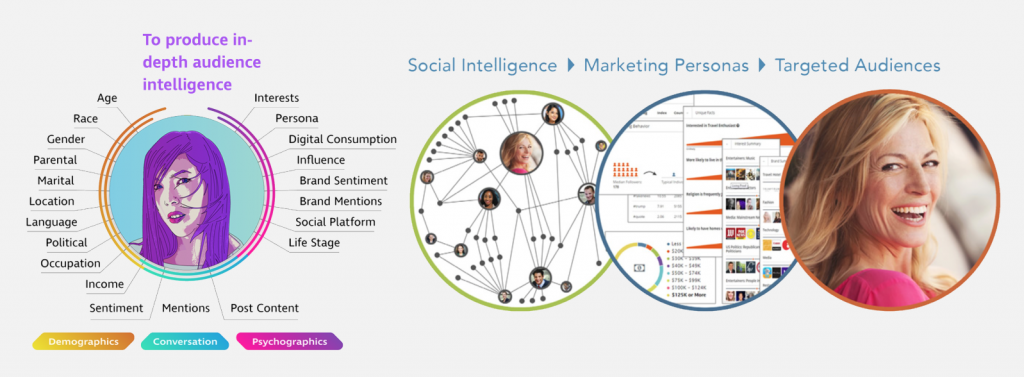

Social listening gives us clues related to our customer, our competitor and our marketplace based on conversation analysis at scale. These clues lead to insights that inform laser specific strategy for ALL silos in the enterprise. In addition, we can build a customer base from conversation analysis by enriching handles of those in the conversation. In addition, we can see who is influencing people talking about our chosen themes/topics.

Sentiment analysis and Emotions analysis gives us insight into what causes Joy, Anticipation, Fear, Disgust, Anger within conversations where our chosen themes and topics are being discussed. This is important because we can design better marketing campaigns, bring efficiency to our overall budget based on what’s working/not working in the marketplace, we can spot trends in the marketplace and anticipate where to focus our resources as a brand.

When we see WHO is talking about themes/topics important to our brand, WHERE these conversations are occurring, WHAT is driving awareness of our themes/topics, HOW customers are arriving to our channels AND to our competitors channels, then we make more intelligent decisions for our brand, for each silo in our enterprise.

Social listening is a process by which insights are derived from truly massive quantities of social data (online conversations, documents, and profiles). We distill these huge amounts of data into digestible insights for business stakeholders, accompanied by detailed datasets of prospects, and individuals/entities who influence these prospects. Software solutions combined with human analysts are our chief means for achieving this work

Our net deliverables are PDFs, spreadsheets and in-person meetings where we deliver insights & recommendations related to our research. These deliverables are important because brand leadership has a set of insights/action steps related to discovered individuals (our initial data lake of prospects). We also meet with stakeholders in various business units to discuss the findings, participate in action teams who are executing on initiatives supported by the insights, adjust process and rinse-repeat as needed, honing in on specific additional items desired. This refinement process is where we really drill into the “2nd concentric ring”* and find the exact targets worth acquiring. This is also where we find out what’s working and what’s not working for a specific unit/team.

*The “2nd concentric ring” is everyone who is following a specific influencer. Segmenting and defining the demographics/psychographics/personalities of every single person following an influencer gives us a better idea about whether this influencer is a good pick for our organization. We also find out a lot more about our ideal consumer when studying the “2nd concentric ring”. This is important because when we see every single person who has chosen to follow and engage with an influencer, we gain insight into the culture, buying choices, and online habits of our ideal consumer.

………..

THE NITTY GRITTY PROCESS 2019 (STEP BY STEP):

1. Define the questions/problem to be answered. This is done by sitting down with the client and interviewing leadership, then specific stakeholders, then those who work with specific stakeholders. It is best to do this in small groups or with individuals so as to get honest and truthful information. This is important because we want to start our study with a very deep set of insights on the organization and those who will be using our research. When I interview stakeholders and their teams on an individuals basis, I learn more than when I interview a group together. When I interview a group together, all of the politics and internal issues prevent individuals from sharing fully what is needed.

2. Define the scope/parameters – dates/topics/desired outcomes. After interviewing everyone, I have insight into how the organization will be most helped by the research work. Very few internal stakeholders and employees in the enterprise have the “big picture” view. Usually each person is interested in his/her own agenda or in pleasing specific senior stakeholders. When we know what is at the heart of the organization’s psyche, it’s heartbeat as it were, then we can deliver a scope of work that truly meets the brand’s need vs. individual stakeholders’ needs. This is important because we want our work to feed the brand, to nourish it’s life. A brand can breathe when fed useful insights, and it can die if it is shielded from useful insights. Truth about the marketplace, the consumer, the competitor, and, importantly, the inner body of stakeholders, employees, vendors, contractors and non-human drivers is vital.

3. Define the audience for the report(s) – who is this for/what is purpose of study/why are we doing this study. Each insights report we deliver will nourish a specific person, unit, division, region. When we know the true need, as stated in the last point, we can speak to the audience who has this need…we can speak to the heart of the organization itself. Knowing one’s audience affects one’s voice, one’s tone, one’s approach. This is important because we want our insights to be digestible, used, passed around. We want our research to truly affect change in the organization, change for the good of the brand.

4. Gather existing pre-study materials from the client and study these. Ask client questions about submitted materials. Gather more materials if needed/available.

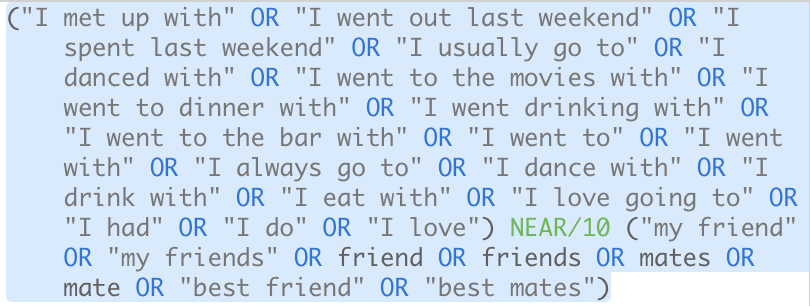

5. Create boolean queries for conversation data aggregation in a conversation analysis tool.

6. Refine these boolean queries for more precise conversation data aggregation.

7. Download the raw mentions from the conversation analysis tool.

8. Download other relevant sheets from the conversation analysis tool, including Topics, Most Mentioned Authors, Most Used Hashtags, Leading Authors (in terms of Inf), Leading Sites (blog), Leading Sites (forum), Leading Twitter Authors, Leading Blog Authors, Leading Forum Authors, targeted Mentions downloads (using Rules and sub-queries within the search field in the Mentions tab.

9. Organize conversation data downloads, cleaning up columns, deleting un-needed columns/rows, filtering for site type and putting into separate sheets/tabs in Excel.

10. Enriching the Twitter handles/Instagram handles with additional info about those authors using audience intelligence solutions.

11. If needed, further enriching these titles with add’l social handles using APIs that give us PII (phone, email, address, etc.).

12. Analysis of conversation snippets for insights (junior analysts do this, filling in coding columns and insights columns).

13. Analysis of leading sites.

14. Analysis of leading authors.

15. Upload specific sets of conversation snippets into a tool using the LDA algorithm (Latent Dirichlet Algorithm) for Topic Modeling and Emotions Analysis.

16. Look over analysts’ hand coding work and develop macro insights based upon this work.

17. Look over emotions analysis and topic modeling for add’l insights.

18. Look over the types of people talking (from audience intelligence tools) and add add’l insights.

19. Conduct in-person focus groups, where needed/if required by client (using ideal candidates found from the conversation/audience data analysis).

20. Create final reports with insights, recommendations, appendix and, where needed, the working Excel sheets. Add charts and graphs to Appendix of report.

21. Deliver Insights report to client.

22. Deliver an Excel sheet of the enriched author handles, along with addl charts containing psychographic insights, influencer insights, related to these authors.

23. Deliver Excel sheets from audience intelligence dashboards (includes offline insights from sources like Acxiom and Experian).

24. Go over recommendations one by one with the client.

25. Ask client if there are add’l questions they have. Identify opportunities to collaborate on future research together.